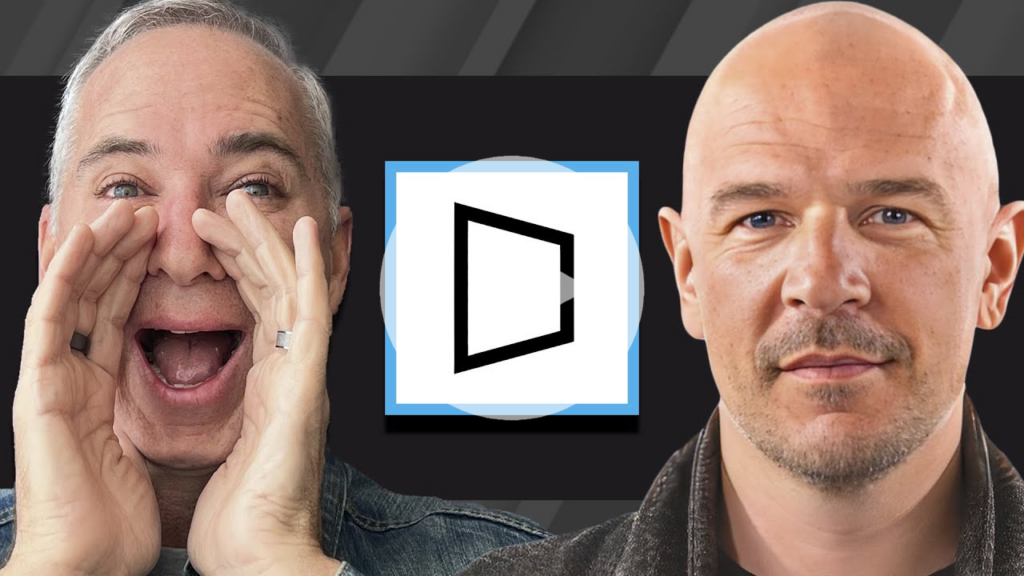

Our guest today is CapIntel’s Co-Founder and CRO, Rob Crnkovic.

CapIntel is a B2B wealth management platform for financial advisors and asset managers that enables them to save time, and easily articulate the value of investments to their customers.

Rob joined CapIntel with over 10 years of B2B sales leadership experience as a former executive at Slack, Salesforce, and Plaid. He led high-performing teams focused on the Financial Services Industry and has successfully applied his experience to build small but mighty sales teams that continue to scale quickly.

Through his sales leadership, CapIntel has inked major deals with some of the biggest names in the wealth management industry, including BMO Global Asset Management, IG Wealth Management, Canada Life, and Equitable Life.

In This Conversation We Discuss:

- What lessons Rob learned from Salesforce that he carried with him into CapIntel

- What secrets Rob can pass on for those learning to do enterprise sales

- How to resist the urge to create every customer request and focus on giving them what they need

- How banks are deciding what systems to integrate with to fit their needs

Resources:

CapIntel – https://capintel.com

Connect with Cameron: Website | LinkedIn

Get Cameron’s latest book “Second in Command: Unleash the Power of your COO”

Subscribe to our YouTube channel – Second in Command Podcast on YouTube

Get Cameron’s online course – Invest In Your Leaders

—

Watch and Subscribe to our Podcast on Youtube

Our guest is CapIntel‘s Cofounder and CRO, Rob Crnkovic. CapIntel is a B2B wealth management platform for financial advisors and asset managers that enables them to save time and easily articulate the value of investments to their customers. Rob joined CapIntel with over ten years of B2B sales leadership experience as a former executive at Slack, Salesforce, and Plaid.

He led high-performing teams focused on the financial services industry and has successfully applied his experience to build small but mighty sales teams that continue to scale quickly. Through his leadership, CapIntel has inked major deals with some of the biggest names in the wealth management industry, including BMO Global Asset Management, IG Wealth Management, Canada Life, and Equitable Life. Rob, welcome to the show.

I’m really happy to be here. Thanks for having me.

I’m looking forward to learning a little bit about your journey and what CapIntel does. Why don’t you start off and walk me through some of your leadership growth over the last few years? I’m particularly interested just to hear about what it was like working at Slack and also at Plaid.

I was a business student. In Canada, the tech scene really hadn’t taken off, and this was many years ago. RIM, Research in Motion, was really the hot company, and it was starting to kick off the Waterloo tech hub there. A natural place for a lot of business grads was to go into CPG. I did that for almost ten years. I had a lot of friends. Salesforce actually opened up there, a North American office, an office in Toronto that covered most of North America from a commercial sales perspective. I had a lot of friends that I went to school with that went to Salesforce. They had been there many years and were always telling me about how great it was.

Finally, I decided to make the jump, so I moved over to Salesforce. At the time, I moved from Stanley Black & Decker. I was a General Manager for their outdoor lawn garden business. I moved over to Salesforce, and I was actually given that Stanley Black & Decker account. One of the coolest experiences was at Stanley Black & Decker Canada, I reported to the president, and I couldn’t dream of being in the same room as the CEO of Stanley Black & Decker Corporate.

Within two months of me being at Salesforce, I was in a room with the CEO of Stanley Black & Decker Corporate and talking about strategy and things, and that’s what got me hooked on software and software sales. Just to be in the room with incredible leaders like that and being able to make an impact on our business, it was like tech sales all the way.

I’ve got a funny story, and it’s only going to be a first name. 1994, I had a roommate in Toronto who was at Black & Decker. His name was Ron. He’s a super fun guy that would have been in the sales and marketing arena right around when you were there.

Black & Decker was a really interesting place because they subscribed pretty closely to the old Jack Welch, like 20% get promoted. It was a really great place to advance your career quickly, but there were also a lot of tournaments. I learned a ton in that business, but Ron wasn’t there or whatever.

I wish I could remember his last name because he was a great guy too. Funny about the CPG, you’re the second person in two days who’s talked about the CPG experience, and it doesn’t come up very often because that was just kind of the space that I wanted to get into after university as well. What do you think you pulled from the CPG space, the Consumer-Packaged Goods that you still carry with you now in growing the company?

The thing about CPG is tech sales, and tech is a little interesting, especially on the go-to-market side, because it’s very much like pay-for-performance. You don’t necessarily have to be super senior to potentially accomplish some of your financial goals and different things like that, or even your goals of being in the same room as the CEO of Stanley Black & Decker. You can do that even as an IC within tech sales. Whereas, consumer packaged goods, it’s much more about moving up the chain of command and increasing your purview.

One of the biggest things that you aspire to do in CPG is own a P&L. I was fortunate enough to own a P&L relatively early in my career. I was under 30 years old, getting to dive into a P&L, and make decisions around the P&L. As you start to do enterprise sales, it’s super key to understand the business and the decisions and the experiences these business owners are having. I was really fortunate to have first-person experience about, “Do you grow sales? Do you cut costs? If you’re bringing new costs in, how do you justify that?”

A lot of the ROI and the decision-making behind it, I had some purview into it, and I thought that was really helpful. Ultimately, what we’re trying to do is enable these business owners to either save money, grow their business. It’s really important to have that experience or have that background. At least, I found it to be really valuable.

That was the key that I was hinging on as well. I was hoping you were going to go there. I wasn’t really looking from a packaging or a branding perspective, which I think you also get, but it really is owning the P&L of a business or a business unit that I think most business people don’t understand. It’s astounding to me that most employees don’t understand the basic P&L of a company. They just don’t get it. That’s something that all leaders need to get. When you were with Salesforce and getting into enterprise sales for the first time, are there any lessons that you picked up there that you still carry with you now?

I had two versions of my career, and they were all really successful. I was fortunate that I was at Salesforce nine years. I was in a unique position that we had a club, which were different levels of making your number. I was fortunate enough to make club every year and make Chairman’s Club. I had nine years of over-delivering on my quota, both as a salesperson and as a sales leader.

My first years were as like a really successful IC. A gentleman named Keith Block came in from Oracle to be President of Distribution to make Salesforce an enterprise company. One of the big focuses was, “Let’s focus on financial services. Let’s talk the language of our customers.” I was fortunate enough to be given JP Morgan Chase as an account. I remember doing everything you’re supposed to do as a salesperson. We had a deal all locked, lined up, we committed it, and the deal fell apart at the last minute. We’re really fortunate we’re able to scramble and make the number.

After that, I was given a mentor. It had been like before the mentor was grit, personality, hard work, hopefully, there are some things I understood. After the mentor, I learned that sales is a vocation and there’s an actual process to it. I give so much credit to some of the great leaders at Salesforce for really teaching people how to truly sell an enterprise deal. It’s a complicated dance. There are best practices, there’s process, and it’s definitely repeatable if you do it in the right way. For me, that changed my life and the trajectory of my career was to really learn true enterprise sales.

That’s super interesting about the true enterprise sales and what it is. I’m going to ask you a couple more questions around that. My wife led all the Salesforce Engineering Teams for Ticketmaster. She was on a different side of a similar business. I guess you went to a couple of Dream Forest events in San Francisco?

Yes. I remember Ticketmaster and Live Nation. We had some awesome customer stories around that. That’s pretty cool.

She led all the engineering for all of the venues for Ticketmaster, probably NFL sites and all the sites. She got all the cool perks. She got to go to everything for free all over America. Then she was finally like, “What am I doing leading engineering?” She was trying to build something that was replacing something that she just spent two years trying to build with these engineering teams and they were already replacing it just as it launched. She’s like, “This doesn’t make any sense anymore.” When you’re doing the enterprise level sales and you’re working with the C-suite on these, what are some of the secrets that you can pass on to others that will make it easier to do enterprise sales? You mentioned the vocation, which I think is just understanding it and treating it seriously and learning. Are there any couple of tricks or tips that you can give?

It depends on the size of your organization. I can give some perspective. Would it be helpful from a startup perspective, from the CapIntel perspective?

Yeah, exactly. Why don’t we even start and tell us what CapIntel is? Then give us a couple of examples of how you’ve done strategic sales or enterprise-level sales for CapIntel.

For sure, I’d love to. We’ve been around in the market for three years. We’re fortunate to have had a lot of success already. We have 12,000 advisors and wholesalers on the platform already. We just raised our first funding round, a Series A led by FinTech Collective out of New York and Fengate Asset Management out of Canada. Ultimately, we’re a client experience and an advisor experience tool. Our goal is really to deliver transparency into the process of working with an advisor and a client.

Sales Leadership: CapIntel is a client experience and advisor experience tool. Our goal is to deliver transparency into the process of working with an advisor and a client.

Right now, one of the main things that a client does is when they invest with an advisor, they’re really investing in investments. They’re moving their money over to put into investments. Right now, there’s a lot of goal-based planning, which I think is the right thing to do. When you work with an advisor, you talk about like, “What are my risk parameters? When do I want to retire? How am I going to make retirement happen?”

What our tool enables an advisor to do is quickly compare investments that you currently have or different portfolios. Then being able to put together a proposal that combines qualitative information and quantitative information to deliver a really good view of what that plan looks like for the end client. We’ve seen a ton of value that we’ve driven both on the advisor side, making them more efficient and contemplating them much more as a salesperson, making their job easier.

On the client side, because we’ve been able to combine qualitative information with quantitative information, I don’t know about you, but if you see Sorrentino or R-squared or all these crazy charts on your investment stuff, it doesn’t mean a lot to me. If somebody says, “It’s a crazy inflationary time and you need some yield because you’re a balanced investor. I’m going to show you a couple of things that make a whole bunch of sense to you and resonate to you personally.” That builds a whole bunch of trust, and it makes people really understand what’s going on so they can ask intelligent questions and build confidence with their advisor and move some money over. That’s what CapIntel does.

We’ve been fortunate to focus on the enterprise and already had a lot of deals. We have three of the largest banks in Canada as customers, the largest insurance provider in Canada, one of the largest national wealth providers, and then we’ve moved into the US with a lot of success on some great brands in the US as well too.

What’s the reason that these banks are working with you? I would have thought that they would have had stuff like this on their own already.

They definitely do, but I think there are a few things that are going on within the market that makes a lot of sense for us. This is part of the selling process of a startup to a bank. One of the things you need to be able to do is really articulate a vision of where the market is going and where that bank needs to be. Then you need to be relatively tactical and precise about the problems you can solve for them relative to their existing tech stack and what they’ve built and everything like that.

For us, the vision that we see, and it’s shared very commonly across our customers, is that advisors are no longer exclusively stock pickers. They need to be relationship managers, and they need to be able to really deliver a great customer experience. One of the things that we’re seeing as a consistent theme is that banks, where they traditionally would build everything, now are viewing vendor technology as a great way to quickly establish client experience and build a great stack for advisors.

By the way, it’s super competitive to get advisors to work at one company or another, and the tech stack is a big differentiator. That vision is shared and that’s going on. We’re fortunate to have an incredible CTO and Cofounder named Max, and then James is our CEO and Founder. It’s not just the go-to-market motion, it’s also the product that needs to support it. You need a scalable product like something that’s going to work for thousands and thousands of users. We also need something that’s componentized and integratable with API-first technology.

We know that a bank has legacy solutions here and legacy solutions here. How do we fit into them and solve the problem in a really meaningful way? We also need to basically have the whole company aligned to selling to the enterprise. Product people need to be on the phone. Dev people need to be on the phone. Security people need to be on the phone. You can’t say you’re an enterprise company, and then security, not the enterprise-grade. Do you know what I mean? All assets of your company have to be on the same page that this is your ideal customer profile, and what’s it going to take to sell to them and then be fully committed. It’s much more of a decision than a hope if you’re going to sell to the enterprise.

I like the fact that you’re even talking about the integration with some of the legacy systems. I also think it’s interesting that these big banks are finally deciding they don’t need to build everything on their own. Many years ago, they were always building everything completely on their own. They were always on these solutions that already existed. They could have just plugged in. Are they doing that across the board now? Do you find that the banks are trying to plug in best-of-breed software across the board?

Yes. I feel like there are certain areas where it still is heavily homegrown. Personally, I think it makes sense in some of those areas. There are certain things around scale or security where the banks really want to own that. There are areas around advisor experience, customer experience, client experience, onboarding, where the expectation is so incongruent with the current experience that the only way to get to where it needs to be is through vendors and picking to your point like those best and breed solutions.

That’s why I think it’s really important as a startup to understand where you fit in that whole ecosystem and align to the vision of whatever persona that you’re selling to is. If you understand that persona is undergoing some massive transformation and undertaking, you need to think about how you can benefit from that or accelerate that transformation rather than being like, “Why can’t I get my two hours?” Versus maybe somebody where your tool can make the most material impact in the shortest amount of time. Then maybe it does make sense to really go full frontal on that engagement. Being in tune with what their needs are is really important.

Is it different selling into the US financial services industry versus selling in Canadian? I guess there’s the obvious one, you’re a Canadian company, but once you’re past that, is it different or is it the same?

I think it’s different. It’s much easier to sell to the US than it is to Canada. A lot of people assume that to be the opposite, but the amount of competition in the US breeds a little bit more urgency. In Canada, there are five major incumbents, and so they’re exceptionally innovative. They do really cutting-edge stuff digitally, which I think is a real big benefit. They also have fortress balance sheets and they mitigate risk.

Just naturally, Canadians are a little bit more consensus-driven. It’s been my experience. You’re always selling to multiple stakeholders, and being multi-threaded is the key to any kind of enterprise deal. In my experience, if you need to talk to 20 people in the US, you need to talk to 45 people in Canada. In the US, we found it to be a little bit quicker deal cycles.

Sales Leadership: Being multi-threaded is the key to any enterprise deal.

It’s funny, I’ve heard that even about West Coast Canada versus East Coast Canada. I’ve heard it’s much easier to sell to the people on the East Coast like in Toronto, New York, and Boston because they tend to move faster, have more urgency, they get things done. The people on the West Coast are a little more laid back, a little more chill. At least, all the Canadian banks are based on the East Coast.

A friend of mine was one of the founders of a financial law firm in Toronto called Wildeboer Dellelce. They led the Research in Motion, the RIM offering many years ago. That’s how they cut their teeth in this space and used that as the entry point into a lot of US deals. Do you find that because you started in Canada, you got in with some of the Big Five banks? Has that allowed you to get in the doors of the US now? Because everybody knows BMO and Bank of Nova Scotia and TD and Royal. All those brands are really well-known in the US. Has that opened doors for you?

Real quick story on the RIM stuff. BlackBerry had just come out when we were in co-op. I don’t know what was going on. Maybe I just didn’t have the grades. For the life of me, I couldn’t get a Blackberry co-op. I was just dying to get a co-op. A bunch of my friends didn’t. We’d be sitting in this auditorium. One person at the very front would be giggling with a person two seats behind me. I’d be like, “What’s going on?” Because they were co-ops at BlackBerry, they got the early, old BlackBerrys where you’d be talking, and they were talking. We’re like, “What is going on?” in real-time.

Anyway, I remember thinking, “How cool is that?” Surprisingly not, I think our funding has helped us the most in that we found financial services companies to be super open to talking to fintech. A lot of them have put together fintech teams and partnership teams. As soon as we got the funding, we were able to articulate the problem we were solving. We’ve tried both paths like, “We do business with BMO. We’d love to do business with you.” That never got us as much traction as, “We’re this exciting fintech that just raised some money, and we’ve got a lot of customers and we’re solving this problem.” That seemed to get us in a lot more doors, which intuitively, I would have thought that the large Canadian institutions would have been much better.

Traditionally, within financial services, it’s really important to gain a brand in terms of customer brands. The more you can get customer brands in different ideal customer profiles, generally the easier it is to do that. The Canadian brands haven’t translated to the US, as well as the problem statement that we’re solving.

I love the fact that you’re legitimate, “We’re a legitimate company. We’ve raised money from a couple of USBCs in the fintech space. This is what we’re doing. This is how we solve it.” That’s legitimized enough. They don’t need to know that you’ve landed some part of a Canadian company.

I think so. It’s almost been interesting when we lead with the top three banks, some of the feedback is a little bit like, “You’re a Canadian company. Do you understand the US problem?” The US problem, fundamentally, is really similar. We actually started with the US problem as the thing that we were solving because we always aspire that that was the time that we wanted to go after but Canada was in our back door and right beside us. We live here.

We started talking to folks initially in Canada and took off really well. From a regulatory perspective, from a competitive environment, and even from a customer perspective, really similar problems. Often, when we lead with like, “We’re a Canadian company working with Canadian businesses,” it’s not as exciting potentially for us to get that first meeting as when we talk about us being fintech solving really needy problems.

Talk to me about the Series A. How much did you raise? What was it like when you did that raise? What did it change and what were the lessons that you learned doing the Series A to get to completion?

James, our CEO, is an ex-investment banker and an accountant by trade. He led that but asked me to ride shotgun a lot of those pitches and through the whole process. We raised $11 million US. It was led by FTC, FinTech Collective, out of New York. It was followed by Fengate Asset Management in Canada, one of the largest asset managers here. The process was really exciting. We met so many different VCs.

What we learned is that at first, we were trying to tell an exciting story that we thought VCs would be interested in. Then really quickly, what we realized is rather than trying to tell an exciting story that VCs would be interested in, we have a really great business. We were fortunate enough that we didn’t necessarily have to raise. We were in a bit of a unique position. We thought, “Why don’t we just tell our story and what we want to do? Naturally, that will help us choose the VC that makes the most sense as well too.”

That was our method of interviewing VCs. It was like, “We’re not going to tell the story that we think people want to hear. We’re going to tell the story of where we want to grow and of who we are today and where we want to go. If that resonates with people, let’s get really deep and help them understand what they need to about us. Let’s try and understand what we need to about them.” That changed how we were thinking about it, and how we were pitching helped us get really quickly down to the folks that made the most sense for us and whom we made the most sense for, which made it a fun close.

Has it changed anything? When did you finish the close?

We finished it in May and then we announced it in June. It has totally changed things. It’s afforded us the opportunity even from a hiring perspective. We were always aggressively hiring, but our candidate profile changed. We went from hiring exceptionally talented, bright, gritty people to exceptionally talented. We started looking for exceptionally talented, bright, gritty people with subject matter expertise that have done it before and could come in and bring processes and could bring experience, and maturity to the business.

One of the challenges I still have is I’m so close to Max and James. We talk a couple of times a day. Sometimes you fall into that pre-raise mentality where it’s like a gut feel, and a lot of things are notional and emotional, and I feel like this is happening. We’re talking like, “I’m feeling this. Maybe we should do this.” Post-raise, we’re trying to be a mature data-driven business. They’re great partners to be able to remind me and say, “Maybe we should do due diligence. Let’s talk to our people.” We hired really smart people. That’s the difference from pre-raise, post-raise is just the experience that we’ve brought in and the maturity that we’re trying to drive in the business.

It sounds like you’re going to be using most of the cash or some of the cash then for building out your next A-level team for really scaling up the leadership in the next team. How many employees do you have now?

We’re just under 60.

Not a huge company yet either. That’s a nice size still to be able to focus. With 60 employees, is the focus then to start going after more on the sales and marketing side? Is it on the engineering side? What’s the focus on people right now?

Traditionally, we’ve been heavier on the engineering side. We’ve been really focused on what we mentioned earlier. You can’t just say, “I’m going to sell to the enterprise.” You have to have a product that can be sold to the enterprise. It takes a lot of work to build a configurable platform versus a customized platform. You see so many times that people say, “Can you do this?” or “How do we make it our own?” All of a sudden, you land that client and the entire dev and engineering team just has to build new stuff. It basically becomes a custom development operation for whatever your large customer is.

Really fortunate that we’ve been focusing on building an API-first platform that is componentized, that’s configurable, that’s scalable. A big focus on that side. We’ve been growing, I would say, our business group like finance, operations, human resources, and then also a big focus on go-to-market. One of the areas, frankly, I underestimated, but you can get to $3 million or $4 million in ARR by nailing a couple of big clients, and then sprinkling some other stuff in there.

To go from $3 million or $4 million to $10 million to $15 million, you have to back it up with a pipeline. You really have to back it up with a go-to-market machine, a process. We’ve been heavily investing in that. One of the places personally I didn’t invest heavily enough was around the marketing engine. We were getting so many referrals. Our close rate is really high. Now, what we’re focusing on is just continuing to be able to grow our top of the funnel with the right customers. We know who our buyer persona is, but we also know who our next 3 personas are that if we touch them and have them interested in our business as well, our close rate goes up. We’re starting to heavily invest in a real data-driven marketing engine. We’re already starting to see some great impact.

Is it only on the financial services? Are you on the insurance side of things as well? Are you working with groups in the US called Advisors Excel, or are you only on the stock side of things or investment?

Anybody that would sell investments. Right now, we have the ability to compare any investments. We’re adding ESG and SMA into the platform this quarter, which is really exciting, but mostly focused on the investment side.

I spoke at an organization years ago called the Top of the Table, a million-dollar round table, but I’m pretty sure they’re all in the investment or the life insurance side of the space, I think. You touched on this if you land the clients, the engineering team just starts building up this custom software. I’d written down something around, “Is it hard to integrate?” How do you resist the urge to say yes to all of those needs that those customers have versus trying to get them to use what you’ve already created? Sometimes you’re trying to get them to adopt a different style of running the business in some ways, I would think.

There are a couple of things. That was probably the hardest transition to CRO, to be honest with you, is that idea of chasing a quota and a CAGR versus really chasing growth and trying to build for growth. Naturally, when you’re a sales leader, even a senior sales leader, you can fall in love with the deal. If you fall in love with a deal and you’re a rep, it may cost you your year. If you’re a CRO and you fall in love with a deal, all of a sudden, your leadership team now starts to fall in love with that deal, and it impacts the process they’re building and how they’re executing.

You can even have, to your point, your engineering team fall in love with the deal and start solutioning how we can build to satisfy all this stuff. The next thing you know your roadmap is off the rails and a whole bunch of things. The one thing is if there are situations where the client is not a fit for us, we’re fortunate enough that we can say no as well. The key to an enterprise deal is a really good fit. There’s no point in closing a massive deal that’s going to railroad your company and cost you 2 or 3 times as much, 6 to 12 months sort of thing. That’s one is understanding if the deal really makes sense and if you fit the need and if your toolset does.

The other thing too is that out-of-the-gate integration is always the question. If you really know the use case and the value that you’re trying to deliver, that’s what helps keep the scope down or legitimize if the scope needs to be bigger. If you’re solving a certain problem, and a lot of people come out of the woodwork and say, “I want it integrated into this, this, and this,” based on an MVP, a Minimum Viable Product, that produces the most amount of value to you, Mr. or Mrs. Customer, do those integrations really make sense?

When we go through that exercise and relate it back to the problem that the champion or the decision makers are usually trying to solve, a lot of times it just comes down to 1 or 2 integrations to the customer master or something significant but something that is reasonable for us and something that we’ve done before.

One of the things that we’ve done that I think has been really bright by our product and engineering team is anytime we do an integration, we build it as a toolkit. It’s always reusable and documented the next time. The first time we do a Salesforce integration, a client basically paid us for that Salesforce integration, but it was done using an API toolkit that’s repeatable. Now, we can hand to the house and say, “We can either be business architects or we can be fingers on keys. Here’s all the information and it’s really easy to do.”

That’s the only way that this truly scales. How about yourself in terms of your growth? Where do you think you’re growing? I’m curious how the company had to evolve or change. You started about a year or so pre-COVID, and then COVID hit with a bit of a whiplash, I would imagine. How did you have to change? Are you a location-based organization? Are you hybrid now? Any changes around that as well? Talk about your leadership growth and then also the company in terms of where you’re located and how you’re building up.

It’s been funny because during COVID, I think one of the most important things you can do is just hire awesome talent. If we can build the right team, I think that goes a long way. That’s one of the most important things I can do personally, I feel, is bringing the right leaders and help enable them to bring the right team in.

We were hiring initially, and one of the first questions people would ask is, “Are you fully remote?” “Yes, we’re fully remote. All good. No worries.” Now, the question we get is, “Do you have an office?” It’s like, “Do you have an office because I want somewhere to go?” Then if we say we have an office, the next question is, “But I don’t have to go, right?” It’s a challenge. I don’t blame folks. They want camaraderie. They want a meeting. They miss people. They want to work with their teams. A lot gets done when you’re together in collaboration. Working from home is so convenient. It gets done and you can work on your own schedule. We see a ton of productivity from people working from home.

We’ve been really thoughtful about how we can almost have a hybrid working environment. We’ve been really thoughtful about trying to get the team together. For example, we just had the whole team out in Halifax. All 60 people were out in Halifax for 2 days. It was super focused around culture and future. It was the first time most people have all ever seen each other. We’ve got some folks in Philly that we’ve built out a hub in Philly. We’ve got some folks in Halifax. I’ve got most of the go-to-market people here in Toronto. It was really nice to get together, but we do have to be thoughtful about giving people the opportunity to work from home, but also facilitating collaboration, and getting them out of the house and together as well too.

It’s a really interesting time on this as well. I just saw Elon put a note out that he’s requiring all employees to show up at the Twitter offices 40 hours a week now. He’s like, “We’ve got things to do. The world’s getting real. We’ve got to stay focused.” I’m like, “That’s hardcore.” There is a bit of a blend with, “We need you to come in. We want you to be around. We have it available.” There’s also that meritocracy of, “If you can work and get things done and be remote, that’s cool.”

I just met with a client of ours, and I have done probably 50 calls with her over Zoom over the last few years. I met her in person, and she’s 5’0″, and I’m 6’4″. I looked at her, and I’m like, “You’re so tiny.” On Zoom, she’s large. She’s a big energy and she’s a go-getter. I meet her in person and I’m like, “You’re this tiny little thing.” She goes, “I know, it’s amazing.”

It’s funny. It’s so different. I love seeing people’s backgrounds. That’s part of the thing I like. I don’t blame people for graying out their background or having the things there. I love when I’m on a call with somebody and peek at what’s behind them. You get a real different insight into somebody sometimes when you see what’s in their office and what’s important to them and pictures that their kids drew and stuff like that. Some of those things I liked on Zoom because you get a different glimpse, but it’s also really nice to be in person with people and have some of those hallway conversations. We’re trying to balance both right now.

Sales Leadership: You get a different insight into somebody sometimes when you see what’s in their office and what’s important to them.

Are you going to open up a US office at some point?

Yes, absolutely. We’ve just got so much momentum in the US. Our head of marketing is out of the US. She came from Backbase. It’s super incredible. We’re really excited about all the stuff Anna is doing. We just hired two strategic sales folks. They came from eMoney and some other places in the wealth space down in Philly. We’re actively growing our US headcount and having an official office down there is in the plans in the short-term for sure.

Last couple of questions. How about your personal growth in terms of leadership? How have you had to adapt as a leader?

It’s been funny because I went from a little bit more of thinking about things macro to jumping into a startup and almost having to be a little bit of everything. I was the Marketer and Customer Success and a Product Manager. Do you know what I mean? It became like in everything, super tactical. Now, I’m going through the process of pulling myself out of that again. On the go-to-market side, we’ve hired our Head of Customer Experience. We’ve hired our Head of Marketing, got a Director of Sales, and segmented it. We built out really great high-functioning teams.

Now, I’m just bringing myself out of those day-to-day deals. I still send a LinkedIn message to somebody sometimes and do some prospecting. It’s like, “Is that the best use of a CRO’s time?” Probably not. Just getting back to thinking about the business strategically and helping my team run their teams and have some autonomy and get the engine going. That’s just been a really interesting experience from getting back into it and then thinking about building a real big growth muscle that’s repeatable.

Will you need to do a Series B, or are you going to be able to scale from where you are? Are there any thoughts on that?

The way we’re thinking about it is we have no plans to do a Series B right now. We’re really fortunate in the timing of our raise. Also, one of the things that we’ve seen is the deals for us have slowed down a little bit, meaning that it takes a little bit longer. Deals maybe that we thought we were going to close in the second quarter, closed a couple of months into the third quarter. We’re really fortunate that we’re still doing a lot of deals and doing some deals that we’re proud of.

We haven’t seen the volume of deals or the number of deals go down. The way we’re going to play it right now is just to continue focusing on the US market growing there. We’ve been meeting some different strategic and different funds who are really excited about what we’re doing and that we think could be cool partners, but no plans to actually do another roadshow at least for another 14 to 15 months.

I want you to lean back a couple of decades and go back to the 21 or 22-year-old Rob, and you’re going to give yourself some advice. What advice would you give yourself back then that you know to be true now but you wish you’d known when you were just starting your career?

That’s a really good one. I was fortunate to fall into a couple of mentors both in CPG and then Salesforce. When you’re young, you just think the world’s ahead of you, and you know better than everybody and you’re about to just embark on this crazy, awesome career. I wish I would have sought out more mentorship proactively, and done it earlier, and in a much more meaningful way, just because of the impact it’s made on me and my career.

That would be my advice to anybody who’s starting any career, is really just go out and try and find some mentorship and ask some questions and learn. Even if it’s not specific to your role, even if you want to learn about the next role or whatever it is, or just talk to people about how they run their business so you can have an understanding of P&Ls or business decisions. I just think it’s impactful to have somebody helping you out.

When I was the Chief Operating Officer at 1-800-GOT-JUNK, this is now going back many years ago for me, I did have a formal mentor who was being groomed as the COO at Starbucks. What you just mentioned, as soon as I get off with you, I’m going to send Gregg Johnson a Loom video and say thank you for that. He put his time into me over the course of eighteen months with monthly calls and every quarter in-person stuff. It’s time to drop him a Loom video. Maybe you can send one off to your mentor as well and say thank you.

I think that’s a fantastic idea because just a little bit of time can make such a massive impact on somebody, and I know it happened to me. That’s an amazing idea.

Let’s both take two minutes and send a Thank You to our mentors. Rob Crnkovic, the Cofounder and CRO for CapIntel, thanks so much for sharing with us on the show.

Thanks for having me.